In recent years, the realm of cryptocurrency trading has experienced a seismic shift. As digital currencies gain traction and volatility becomes the norm, traders are increasingly turning to technology to maximize their investment potential. Enter crypto trading bots—automated systems designed to manage trades and execute strategies on behalf of investors. These bots are not just a passing trend; they are fundamentally transforming how individuals approach the crypto market.

The Rise of Trading Bots

Crypto trading bots began to surface around 2016, coinciding with the unprecedented growth of Bitcoin and other altcoins. Initially developed for institutional investors, these automated tools have since democratized trading for the everyday enthusiast. With their ability to analyze market data at lightning speed, trading bots can identify opportunities that human traders might miss.

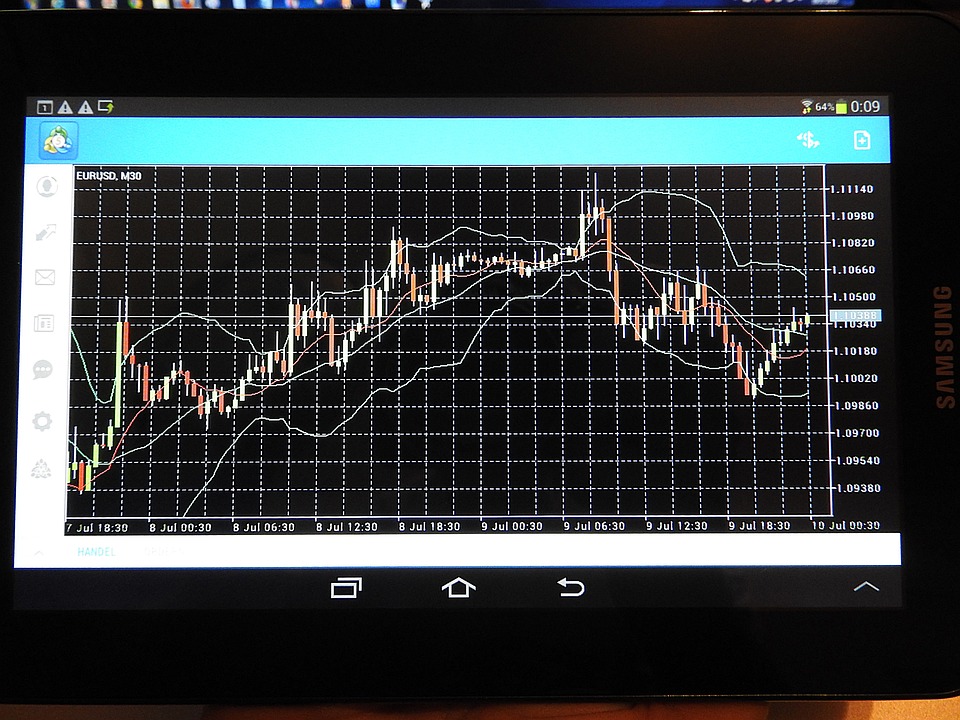

The bot’s algorithms can analyze prices, volume, and historical data to predict market movements. According to a report by Statista, the global cryptocurrency market was valued at approximately $1.49 trillion in 2021 and is expected to continue expanding, creating a fertile ground for trading bots to thrive.

Advantages of Using Trading Bots

The allure of trading bots lies in several key advantages:

- 24/7 Trading: Unlike human traders, bots do not require sleep or breaks. They can monitor the market continuously, taking advantage of opportunities around the clock.

- Emotionless Trading: Trading can be highly emotional, leading to impulsive decisions. Bots operate based on pre-set strategies, eliminating emotions from the equation.

- Speed and Efficiency: Bots can execute trades in milliseconds, catching opportunities before they disappear.

- Backtesting Capabilities: Many bots allow users to test strategies using historical data, helping traders refine their approaches before committing real capital.

Research by the Cambridge Centre for Alternative Finance indicates that more than 50% of crypto traders use some form of automation in their trading strategies.

Types of Trading Bots

Not all trading bots are created equal. Here are some of the most popular types:

- Market Making Bots: These bots provide liquidity to exchanges by placing buy and sell orders, profiting from the spread between them.

- Arbitrage Bots: They capitalize on price discrepancies across different exchanges, buying low on one and selling high on another.

- Trend Following Bots: Utilizing technical analysis and indicators, these bots identify and follow market trends, executing trades that align with the current momentum.

- Signal Bots: These bots operate based on signals from other traders or social media platforms, executing trades based on community sentiment and insights.

The Challenges Underscoring Automation

Despite their advantages, crypto trading bots are not without challenges. The volatility of crypto markets can lead to unpredictable outcomes, often surprising even the most sophisticated algorithms.

Moreover, bots are only as good as the strategies they employ. A poorly designed algorithm can lead to significant losses, especially in erratic market conditions. CoinMarketCap has highlighted that while trading bots can make profits, they also risk losing money, emphasizing the necessity of careful strategy selection and regular monitoring.

A Glance into the Future

The future of crypto trading bots looks promising. With technological advancements and machine learning integration, these bots are evolving to make ever-more informed trading decisions. Developers are pioneering bots that can learn from past trades and adjust strategies dynamically, improving overall performance.

Furthermore, regulatory frameworks are beginning to emerge, providing structure and safety for users. As regulations become clearer, trading bots may experience increased adoption from institutional investors, further embedding them in the market landscape.

Conclusion

As crypto continues to gain traction in the global financial landscape, trading bots are poised to play a crucial role. They offer a unique blend of speed, efficiency, and analytical prowess that enables traders to harness opportunities that were previously out of reach. However, while they present significant advantages, traders must remain educated, aware of the risks, and invest time in understanding the technology behind these bots.

In summary, whether you are a seasoned trader or a curious newcomer, exploring the world of crypto trading bots could unlock new profit potentials and revolutionize your trading strategy. The bots are here, and they are reshaping how we interact with the ever-evolving crypto markets.