The cryptocurrency market has evolved considerably since the inception of Bitcoin in 2009. What began as a niche interest among tech-savvy enthusiasts has burgeoned into a $2 trillion economy teeming with diverse digital assets. As this market grows, so does the variety of trading platforms available to consumers, offering innovative features that cater to different trading styles and preferences. This article explores the rise of these platforms and the implications for investors in an ever-changing crypto landscape.

The Traditional Trading Model

Traditionally, cryptocurrencies were traded on centralized exchanges like Coinbase and Binance, where users could buy, sell, and trade digital currencies utilizing bank transfers, credit cards, and other payment methods. However, centralized exchanges are not without their drawbacks. Issues such as high transaction fees, security vulnerabilities, and limited control over funds have prompted consumers to seek alternatives.

The Emergence of Decentralized Exchanges (DEXs)

In response to these challenges, a new wave of decentralized exchanges (DEXs) has emerged, allowing users to trade directly without the need for intermediaries. Platforms like Uniswap and SushiSwap use smart contracts to facilitate trades, giving users more control over their assets.

“The advent of decentralized exchanges marks a paradigm shift in how we think about trading and ownership in the crypto space.” – Blockchain Expert

By removing the middleman, DEXs have reduced fees significantly while enhancing security. However, they also bring their own set of challenges, such as liquidity issues and the complexities of using blockchain technology for trading. Nonetheless, the growth of DEXs underscores a fundamental shift towards user autonomy.

Innovative Features of Modern Trading Platforms

Innovative trading platforms are no longer just venues for buying and selling cryptocurrencies; they now offer a variety of features designed to enhance the trading experience. For example, platforms like Robinhood and eToro have integrated social trading, allowing users to follow and mimic the strategies of successful traders. This gamification of trading has attracted a younger demographic eager to participate in the crypto space.

Advanced Trading Tools

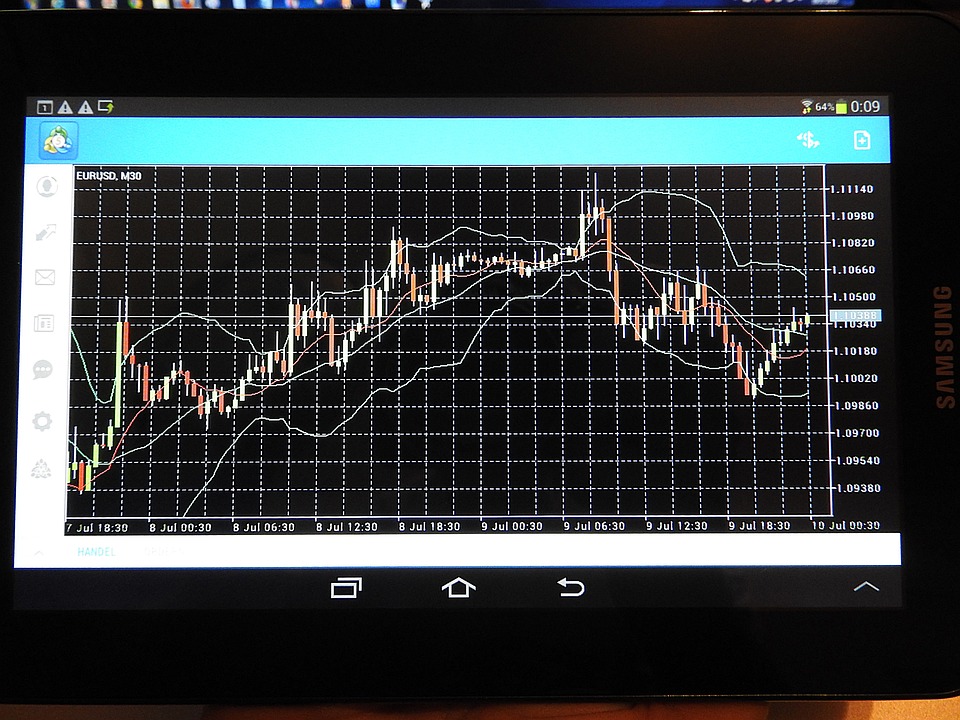

Many of these platforms are now incorporating advanced trading tools such as algorithmic trading, portfolio management analytics, and even tax liability tracking. For instance, platforms like TradeStation and Kraken offer sophisticated charting tools that cater to professional traders looking for in-depth market analysis.

Mobile-First Approach

The rise of mobile technology has also influenced these platforms. Traders are now using mobile apps that offer real-time trading capabilities, alerts, and advanced analytics. The mobile-first approach not only provides convenience but also encourages more frequent trading, which can affect market dynamics significantly.

The Rise of Automated Trading

Perhaps one of the most prominent innovations is the advent of automated trading platforms and bots. These platforms allow users to create trading algorithms that can execute trades on their behalf, based on predetermined criteria. Bots take emotions out of trading, making decisions based on data and analytics alone.

“Automated trading not only saves time but can also lead to more disciplined trading practices.” – Crypto Trader

However, it’s crucial to approach automated trading with caution. If not programmed correctly, bots can incur significant losses. The complexity of the algorithms involved also means that some users may not fully understand how their trades are being executed.

Challenges Ahead

Despite these advancements, the crypto landscape remains rife with challenges. Regulatory scrutiny is intensifying globally as governments attempt to define the legal framework surrounding cryptocurrencies and trading platforms. In the United States, for example, the SEC has been vocal about cracking down on unregistered exchanges and ensuring consumer protections.

Furthermore, the volatility inherent in cryptocurrency markets means that even the most advanced trading platforms can fall victim to sudden price swings. Understanding the risks involved is crucial for any investor navigating this landscape.

Future Trends in Crypto Trading

Looking ahead, the future of crypto trading platforms seems promising yet complex. Innovations in artificial intelligence and machine learning could lead to more personalized trading experiences, allowing platforms to cater to the unique needs of individual users. Moreover, the integration of blockchain technology with traditional financial systems may bridge the gap between the two worlds, enhancing accessibility and interoperability.

Conclusion

The rise of innovative trading platforms marks a significant development in the ever-evolving cryptocurrency market. From decentralized exchanges to mobile trading apps and automated trading systems, these platforms are redefining how individuals engage with digital currencies. However, as consumers become increasingly empowered, they must remain vigilant about the risks involved. Whether one is a seasoned trader or a beginner, navigating this complex landscape requires not just knowledge but also a keen understanding of the tools at one’s disposal.