The cryptocurrency market has surged into public consciousness like a financial wildfire, capturing the imagination of investors and speculators alike. From Bitcoin’s meteoric rise to digital gold status to the meteoric rise of altcoins like Ethereum and Dogecoin, the crypto craze has sparked a debate: Are we not merely witnessing a revolutionary transformation in finance, but rather another market bubble waiting to burst?

The Origins of the Crypto Boom

The crypto movement began in 2009 with the introduction of Bitcoin, the first decentralized digital currency. Created by an anonymous figure using the pseudonym Satoshi Nakamoto, Bitcoin aimed to eliminate intermediaries in financial transactions while providing a means of value transfer free from governmental control. It appealed to those disillusioned by traditional banking systems, particularly following the 2008 financial crisis.

Since then, the cryptocurrency landscape has evolved exponentially, with thousands of alternative coins (altcoins) each proposing unique functionalities and applications. From smart contracts to decentralized finance (DeFi) and non-fungible tokens (NFTs), the possibilities appear endless. But as with any financial innovation, a speculative bubble lurks around the corner.

Understanding Market Bubbles

A market bubble is characterized by a rapid expansion in asset values that are not supported by fundamental financial data, followed by a sharp contraction. Historical examples include the dot-com bubble of the late 1990s and the housing bubble that contributed to the 2008 financial crisis. The unmistakable symptoms of a bubble include an overwhelming optimism, high trading volumes, and a surge in new market participants who often lack experience.

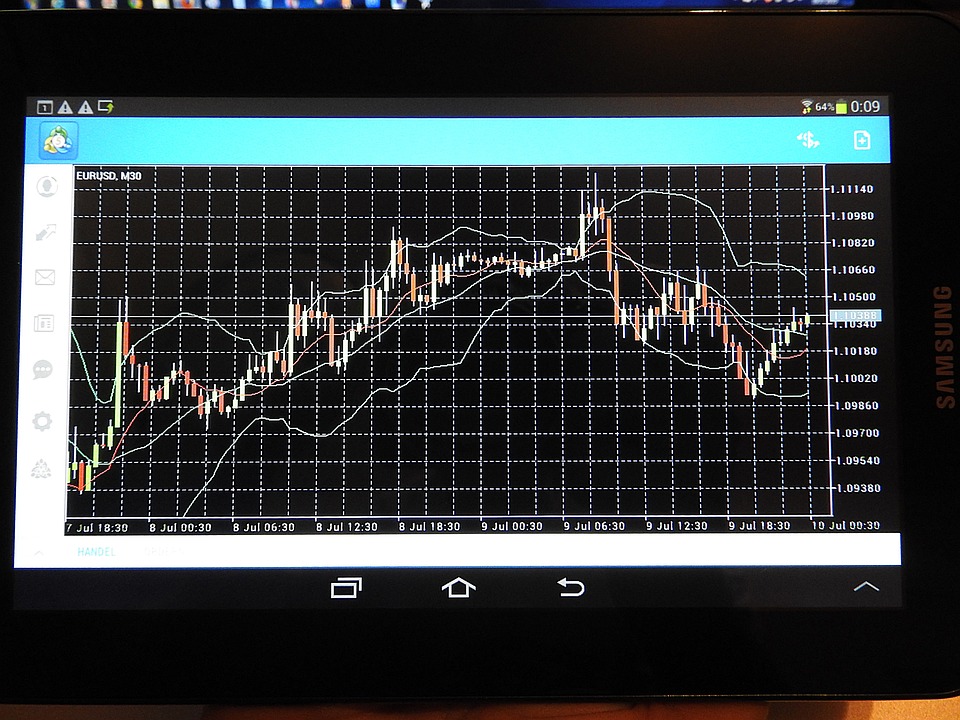

In the context of cryptocurrency, these symptoms have become glaringly apparent. The significant price fluctuations, soaring valuations of coins with little more than a white paper to support their value, and the rush of retail investors seeking to cash in on the trend raise eyebrows.

The Rise and Fall of Crypto Valuations

In late 2021, Bitcoin reached an astonishing peak of nearly $69,000, while Ethereum surged past $4,800. Meanwhile, meme coins like Dogecoin and Shiba Inu attracted media attention for their meteoric rises, creating a perfect storm for speculation. Yet, by mid-2022, the crypto market experienced a harsh correction, with Bitcoin dropping over 70% from its peak.

Investors, many of whom are novices, often flocked to these digital currencies fueled by FOMO (Fear of Missing Out) without fully understanding the underlying technology or market dynamics. The ease of access to cryptocurrency exchanges and the alluring promise of quick riches exacerbated the situation.

Distinct Factors Driving the Current Trend

It’s essential to consider the unique factors that differentiate today’s cryptocurrency market from previous bubbles. Unlike past speculative booms, the integration of blockchain technology across various sectors has genuine potential. Major companies, including Tesla and Square, have begun to invest in or accept cryptocurrencies, lending a veneer of legitimacy to the market.

Additionally, institutional interest from hedge funds, corporations, and financial giants like Goldman Sachs and JPMorgan is reshaping the landscape. However, with institutional involvement comes increased scrutiny, regulation, and market manipulation, factors that can perpetuate volatility.

The Role of Regulations

Regulatory interventions are an inherent part of financial markets, particularly for an emerging asset class like cryptocurrency. Governments worldwide are grappling with how to regulate this uncharted territory. The lack of clear guidelines invites both enthusiasm and apprehension, with many speculating how future regulations may function.

While regulation could bolster investor confidence, excessive restrictions may stifle innovation and deter investment, igniting fears reminiscent of previous market crashes. Understanding the intricate balance between regulation and innovation is crucial for navigating the future of cryptocurrencies.

The Future: Bubble or Evolution?

As the debate rages on, the question remains: Is the current cryptocurrency landscape a bubbling trend bound to experience a catastrophic failure, or is it a revolutionary moment in finance?

Investors have to remember that every investment carries risk. The rise of cryptocurrency may not mirror previous bubbles, especially as blockchain continues to find application in real-world use cases. However, the speculative nature of many coins, coupled with a lack of knowledge among retail investors, creates a scenario ripe for potential loss.

In conclusion, while the crypto craze may exhibit bubble characteristics, it is essential to differentiate between irrational exuberance and genuine technological advancement. Investors should conduct thorough research and approach with caution, ensuring they navigate the fine line between opportunity and risk in this volatile market.

Final Thoughts

The crypto market may very well be a double-edged sword. Its highs can yield significant profits, while its lows can lead to heavy losses. The potential for innovation in finance and technology coexists with the risk of an impending market correction. Whether we are witnessing a bubble or a new financial paradigm, one thing is certain: the cryptocurrency saga is far from over.