In the turbulent sea of cryptocurrencies, AVAX, the native token of the Avalanche blockchain, has emerged as a lighthouse of innovation. In 2023, the project marked several key developments that have captured the attention of investors. This article unpacks these advancements and explores what they signify for the future of AVAX

.

The Rise of Avalanche

Launched in September 2020 by Emin Gün Sirer, Avalanche offers a highly scalable and efficient blockchain platform designed for decentralized applications (dApps) and custom blockchain networks. Unlike Bitcoin or Ethereum, Avalanche utilizes a unique consensus mechanism called Avalanche consensus, which enables rapid transaction finality and lower fees.

As of mid-2023, Avalanche boasts over 1,200+ dApps and has secured partnerships with various enterprises and institutions.

Key Developments in 2023

As we delve into the latest developments, several noteworthy events stand out:

1. Avalanche Rush: Phase 2

In early 2023, Avalanche Rush, a liquidity mining program aimed at incentivizing users to provide liquidity to specific projects on the Avalanche network, entered its second phase. This initiative is expected to increase user engagement significantly, drive new capital into the ecosystem, and enhance the overall functionality of dApps.

2. Subnet Expansion

Avalanche’s subnet feature allows developers to create custom blockchains tailored to specific use cases. In 2023, interest in subnets surged, with several high-profile projects announcing their plans to launch on Avalanche. This includes collaborations with industries like gaming and finance, indicating a robust growth trajectory.

3. Integration with Decentralized Finance (DeFi)

DeFi continues to be a cornerstone of Avalanche’s growth strategy. With AVAX now supported by leading DeFi platforms, including Aave and Curve, investors have more access points than ever. These integrations enhance liquidity and expand the utility of AVAX, prompting significant interest from traders and institutional investors alike.

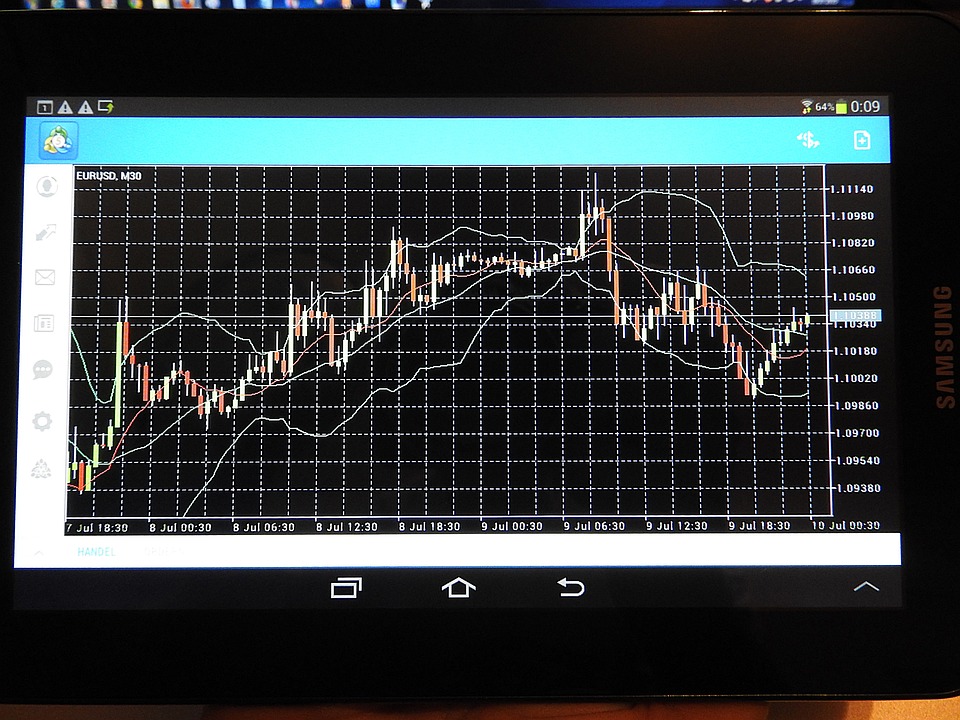

AVAX Price Performance

The price trajectory of AVAX reflects the broader market dynamics while also showing unique characteristics driven by its developments. In early 2023, AVAX traded around $18, but has seen fluctuations typical of the crypto market, accompanied by bullish sentiment stemming from the aforementioned developments.

As of October 2023, AVAX has seen price appreciation to around $32, a testament to the market’s optimistic outlook following the recent advancements.

What These Developments Mean for Investors

These developments collectively suggest a strengthening ecosystem around Avalanche, which is key for investors considering AVAX as part of their portfolio. Here’s what they signify:

1. Increased Adoption and Utility

The expansion of dApps and liquidity programs indicates growing user adoption. With a broader use case, AVAX is likely to experience increased demand, which may lead to an upward price trajectory over the long term.

2. Institutional Interest

The integration with well-known DeFi platforms and collaborations with enterprises signal a growing institutional interest. As institutions increasingly adopt blockchain solutions, AVAX is well-positioned to benefit from this trend, making it an attractive option for long-term investors.

3. Focus on Scalability

Avalanche’s unique consensus mechanism is designed to address scalability issues faced by other blockchain networks. By lowering fees and improving transaction times, Avalanche offers a viable solution for developers and users alike, which further bodes well for the future of AVAX.

Risks to Consider

Despite the optimistic outlook, potential investors must remain cautious. The cryptocurrency market is notoriously volatile, influenced by regulatory changes, technological challenges, and competition from other smart contract platforms like Ethereum 2.0 and Binance Smart Chain. Investors should conduct due diligence, keep an eye on market trends, and consider diversifying their portfolios to mitigate risk.

Conclusion

In summary, AVAX is not just another cryptocurrency; it represents a shift towards more scalable and efficient blockchains. The developments in 2023 highlight Avalanche’s commitment to establishing itself as a leader in the DeFi and dApp space. For investors, it presents both opportunities and challenges. With rising adoption, increasing utility, and institutional interest, AVAX could very well be a player to watch in the coming years. However, as with any investment in cryptocurrency, prudence and thorough research remain crucial.