Cryptocurrencies have revolutionized the financial world, offering both new opportunities and challenges for investors. When it comes to trading digital assets, the choice between centralized and decentralized exchanges can significantly impact your experience. This article will explore the key differences and help you decide which type of exchange aligns with your trading goals and preferences.

Here is the definition of Centralized and Decentralized Exchanges:

Centralized Exchange

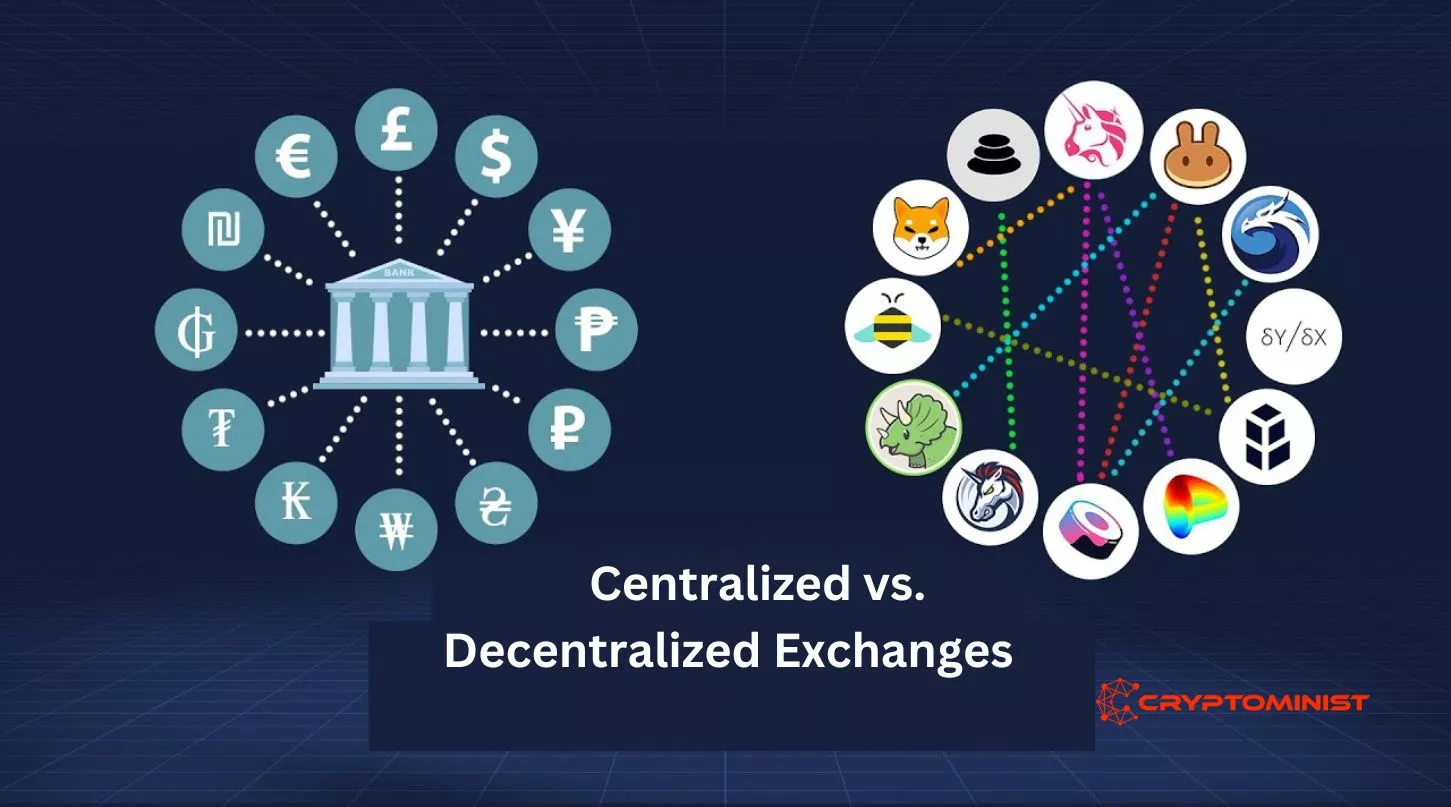

Centralized exchanges operate under the control of a single entity, such as a bank, trading platform, or government institution. This entity manages all exchange operations and cryptocurrency wallets. Centralized exchanges aim to streamline user experience but are susceptible to issues related to centralization, including a single point of failure.

Decentralized Exchange (DEX)

In contrast, decentralized exchanges, or DEXs, are not governed by a single entity. Transactions on DEXs occur directly between users, creating a peer-to-peer network. DEXs are often considered more secure due to their lack of a single point of failure, but they can be challenging for newcomers to navigate.

What are the key differences between centralized and decentralized exchanges?

Here are the key differences between centralized and decentralized exchanges:

1. Usability:

Centralized exchanges prioritize user-friendliness. They offer swift onboarding processes and straightforward trading experiences. In contrast, DEXs place full responsibility on the user, potentially leading to irreversible errors, as centralized exchanges tend to have safeguards for certain user mistakes.

2. Security:

Centralized exchanges, in their pursuit of user convenience, create a vulnerability with a single point of failure. Successful attacks on this point can jeopardize the entire exchange and user funds. Decentralized exchanges, however, are generally considered more secure, with user error being a more common threat than hacking.

3. Fees:

Centralized exchanges typically charge various fees for using their services, including transaction fees and withdrawal fees. These costs can accumulate, especially for active traders. DEXs, on the other hand, often have lower fees, and some even offer fee-less transactions due to reduced overhead expenses.

4. Liquidity:

Centralized exchanges have an edge in terms of liquidity, thanks to their larger user bases and organized order books. DEXs, having fewer users and no central authority, typically suffer from lower liquidity. This can lead to challenges such as price disparities and slippage, particularly when trading in-demand assets.

5. Anonymity:

Creating an account on a centralized exchange often entails providing substantial personal information to comply with regulatory requirements. DEXs may not require users to create accounts, allowing traders to maintain higher levels of anonymity. They can convert their gains into a privacy-focused cryptocurrency and transfer their funds without linking a bank account.

6. Speed:

Centralized exchanges excel in execution speed, with trades being processed in milliseconds, providing an almost instant experience for traders. DEXs, however, are notably slower, taking 15 to 60 seconds to match and complete orders. This delay can be a disadvantage for frequent traders.

Advantages of Centralized and Decentralized Exchanges:

| Centralized Exchanges | Decentralized Exchanges |

| Security: DEXs offer enhanced security through decentralization, reducing the risk of hacking. | Usability: Centralized exchanges are beginner-friendly and easy to use. |

| Anonymity: Users can maintain privacy without sharing personal information. | Liquidity: They provide high liquidity, enabling faster and smoother trades. |

| Reduced fees: Lower overhead costs often result in fewer fees or fee-less transactions. | Speed: Centralized exchanges execute trades almost instantly. |

Conclusion

The choice between centralized and decentralized exchanges hinges on your priorities. If you value ease of use, liquidity, and speed, a centralized exchange may be your preferred option. On the other hand, if privacy and security are your top concerns, a decentralized exchange could be more appealing.

It’s important to note that while DEXs are gaining traction, they are still in the early stages of development. As their usability improves, they may become a more prominent part of the cryptocurrency landscape, potentially challenging centralized exchanges in terms of trading volume. Your choice ultimately depends on your unique trading goals and comfort with technology.

If you like reading the above article, you may also like reading:

CRYPTOCURRENCY: A BEGINNERS GUIDE

WHAT ARE CENTRALIZED EXCHANGES?